Introduction: The Imperative of AI in Modern Financial Compliance

The financial industry is in a constant state of evolution, driven by technological advancements and an ever-complex regulatory landscape. In this dynamic environment, Artificial Intelligence (AI) has emerged as a pivotal tool, transforming how financial institutions (FIs) manage regulatory risks, detect fraud, and ensure compliance. New York City, a global financial hub, is at the epicenter of this transformation, with its vibrant FinTech ecosystem actively integrating AI into compliance frameworks. The recent NYC Bar Association FinTech Conference 2025 served as a critical forum, highlighting the latest strategies and lessons learned in leveraging AI to combat financial crime and navigate regulatory complexities. This article delves into the key takeaways from this prestigious conference, exploring how FinTechs and traditional FIs in New York are harnessing AI to achieve robust, efficient, and proactive financial compliance, thereby attracting high-value advertisers in the RegTech and cybersecurity sectors.

The NYC Bar Association FinTech Conference 2025: A Deep Dive into AI and Compliance

The NYC Bar Association FinTech Conference 2025, held on September 9, 2025, in New York City, was a landmark event for legal and financial professionals grappling with the rapid advancements in FinTech and payment systems [1]. The conference underscored the critical need for comprehensive regulations to manage risks and protect stakeholders in an era of seamless real-time processing and enhanced accessibility of new technologies. Experts from across the industry converged to discuss the legal and practical challenges and opportunities presented by these emerging technologies, with a significant focus on the role of AI in compliance and fraud prevention.

Key topics addressed at the conference included:

- The impact of federal and state laws and regulations on financial institutions engaging with crypto and other digital assets.

- Commercial and insolvency rules for financial institutions holding digital assets.

- Consumer protection issues in cryptocurrency and their impact on crypto projects.

- The evolving litigation and enforcement landscape under the new administration.

- Guidance for legal professionals preparing for financial services in the age of emerging technologies.

- Understanding the current regulatory framework for FinTech firms [1].

A central theme woven throughout these discussions was the transformative potential of Artificial Intelligence. Speakers highlighted how AI is not just a tool for efficiency but a strategic imperative for FIs to keep pace with sophisticated financial crimes and navigate the labyrinthine regulatory environment. The conference emphasized that while AI offers unprecedented capabilities for data analysis, pattern recognition, and predictive modeling, its implementation must be carefully balanced with ethical considerations, data privacy, and robust governance frameworks.

The discussions at the conference provided invaluable insights into how New York’s FinTechs are leveraging AI to manage regulatory risks and combat financial crime. The focus was on practical applications and real-world case studies, demonstrating AI’s capacity to enhance anti-money laundering (AML), know-your-customer (KYC), and fraud detection processes. The emphasis on both legal and practical challenges highlighted the interdisciplinary nature of modern financial compliance, requiring collaboration between legal experts, technologists, and financial professionals.

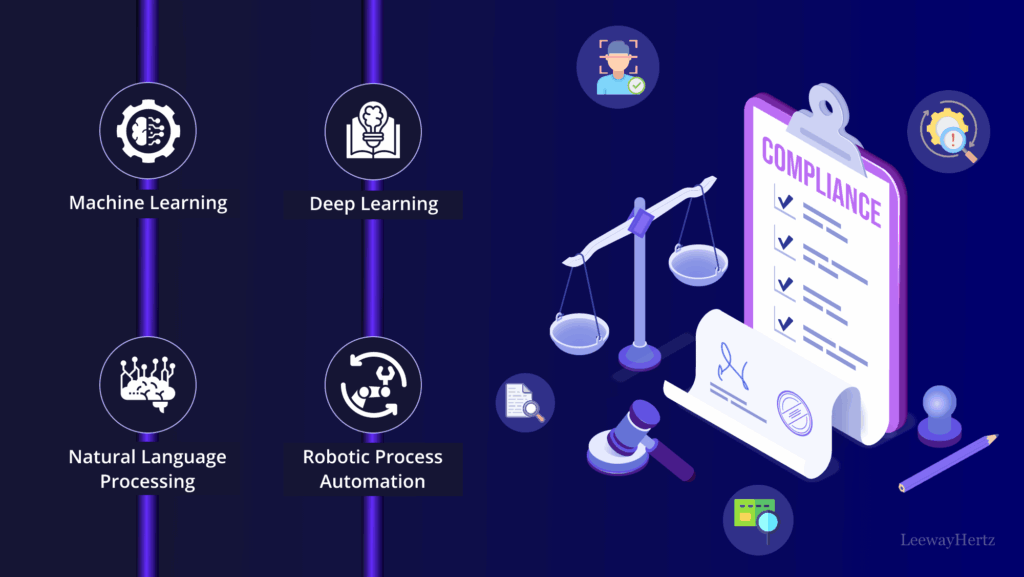

The conference also served as a platform for discussing the future of RegTech (Regulatory Technology), with AI being a cornerstone of its evolution. RegTech solutions, powered by AI, are designed to help FIs comply with regulations more efficiently and effectively, reducing manual efforts and minimizing human error. This focus on technological solutions for regulatory adherence is particularly attractive to advertisers in the RegTech and cybersecurity sectors, who are keen to reach an audience actively seeking advanced compliance tools.

Figure 1: AI for Financial Compliance and Regulatory Solutions.

AI in Fraud Detection: A New Frontier in Financial Security

The battle against financial fraud is an ongoing challenge, with fraudsters constantly evolving their tactics. Artificial Intelligence offers a powerful arsenal in this fight, enabling financial institutions to detect and prevent fraudulent activities with unprecedented accuracy and speed. The NYC Bar Association FinTech Conference 2025 highlighted numerous instances where FinTechs, particularly those based in New York, are deploying AI-driven solutions to safeguard transactions and protect consumers.

AI’s capabilities in fraud detection stem from its ability to analyze vast datasets, identify subtle patterns, and flag anomalies that would be impossible for human analysts to spot. Machine learning algorithms can be trained on historical transaction data to learn what constitutes normal behavior, making it easier to identify deviations that may indicate fraud. This includes detecting unusual spending patterns, suspicious login attempts, or anomalous transaction volumes across different accounts and geographies.

For instance, many New York FinTechs are utilizing AI to enhance their anti-money laundering (AML) and know-your-customer (KYC) processes. AI-powered systems can rapidly screen new customer applications against global watchlists, identify politically exposed persons (PEPs), and conduct enhanced due diligence by analyzing public records and news feeds. This not only accelerates the onboarding process but also significantly reduces the risk of inadvertently facilitating illicit financial activities.

Furthermore, real-time fraud detection is a critical application of AI. By integrating AI models directly into payment processing systems, FIs can analyze transactions as they occur, identifying and blocking fraudulent payments before they are completed. This proactive approach minimizes financial losses for both institutions and their customers. Behavioral biometrics, powered by AI, are also gaining traction, analyzing how users interact with their devices (e.g., typing speed, mouse movements) to verify identity and detect potential account takeovers.

The discussions at the conference emphasized that effective AI-driven fraud detection requires continuous learning and adaptation. Fraudsters are constantly innovating, and AI models must be regularly updated and retrained to remain effective against emerging threats. This necessitates a robust data infrastructure, skilled data scientists, and a commitment to ongoing investment in AI technologies. The premium nature of these solutions makes them highly attractive to advertisers specializing in cybersecurity and fraud prevention, seeking to reach an audience keenly interested in cutting-edge protective measures.

Figure 2: AI for Fraud Detection in FinTech Applications.

RegTech and Cybersecurity: Strengthening the Financial Perimeter with AI

The convergence of regulatory technology (RegTech) and cybersecurity, supercharged by Artificial Intelligence, is creating a formidable defense against financial crime and systemic risks. The NYC Bar Association FinTech Conference 2025 highlighted how New York FinTechs are at the forefront of integrating AI into RegTech solutions to streamline compliance processes, enhance risk management, and bolster cybersecurity defenses.

RegTech, essentially the application of technology to regulatory compliance, benefits immensely from AI. AI algorithms can automate the monitoring of regulatory changes, analyze vast amounts of legal and financial data to identify compliance gaps, and generate automated reports, significantly reducing the manual burden on compliance officers. This automation not only improves efficiency but also enhances the accuracy and consistency of compliance efforts, minimizing the risk of human error.

In the realm of cybersecurity, AI plays a crucial role in threat detection and prevention. Financial institutions are constantly targeted by sophisticated cyberattacks, and traditional rule-based security systems often struggle to keep pace. AI-powered cybersecurity solutions can analyze network traffic, user behavior, and system logs in real-time to detect anomalous activities that may indicate a cyber threat. Machine learning models can identify new attack patterns, predict potential vulnerabilities, and even automate responses to mitigate threats before they cause significant damage.

The conference emphasized the importance of a holistic approach, where AI-driven RegTech and cybersecurity solutions work in tandem. For example, AI can be used to identify suspicious transactions (fraud detection), ensure these transactions comply with AML regulations (RegTech), and simultaneously monitor for cyber threats that might compromise the integrity of the financial system (cybersecurity). This integrated approach creates a more resilient and secure financial ecosystem.

New York FinTechs are particularly adept at developing and deploying these integrated solutions. Their agility and focus on cutting-edge technology allow them to rapidly innovate and bring to market RegTech and cybersecurity tools that are both effective and scalable. The demand for such solutions is high, making this a premium area for advertisers in the RegTech and cybersecurity space, eager to connect with FIs seeking advanced protection and compliance capabilities.

Figure 3: RegTech – The New FinTech.

Conclusion: The Future of Financial Compliance is AI-Powered

The insights gleaned from the NYC Bar Association FinTech Conference 2025 unequivocally demonstrate that Artificial Intelligence is not merely an enhancement but a fundamental necessity for financial compliance in the modern era. New York FinTechs, alongside traditional financial institutions, are actively embracing AI to navigate the intricate web of regulatory requirements, proactively combat fraud, and fortify their cybersecurity defenses. The discussions at the conference highlighted a clear trajectory: the future of financial compliance is intelligent, automated, and driven by AI.

The strategic integration of AI into AML, KYC, fraud detection, and RegTech solutions is yielding tangible benefits, from increased efficiency and accuracy to enhanced risk management and a more robust defense against financial crime. As the regulatory landscape continues to evolve and cyber threats become more sophisticated, the role of AI will only grow in importance. Financial institutions that invest in and strategically deploy AI will be better positioned to meet compliance obligations, protect their assets, and maintain trust with their customers.

For advertisers in the RegTech and cybersecurity sectors, this presents a significant opportunity. The demand for advanced AI-powered compliance and security solutions is at an all-time high, driven by both regulatory pressures and the escalating threat of financial crime. By understanding the lessons from conferences like the NYC Bar Association FinTech Conference 2025, companies can tailor their offerings to meet the specific needs of a market that is actively seeking innovative AI-driven solutions to secure its financial future.

The journey towards fully AI-powered financial compliance is ongoing, but the path forward is clear. New York, with its unique blend of financial expertise and technological innovation, will undoubtedly continue to lead this charge, setting global standards for how AI can be effectively leveraged to build a more secure, transparent, and compliant financial ecosystem.

References

- NYC Bar Association. (2025, September 9). FinTech Conference 2025. Retrieved from services.nycbar.org

- LeewayHertz. (n.d.). AI for financial compliance: Applications, benefits & challenges. Retrieved from www.leewayhertz.com

- RipenApps. (n.d.). Leveraging AI For Fraud Detection And Prevention In FinTech Apps. Retrieved from ripenapps.com

- FinTech Magazine. (n.d.). Everything You Need to Know about RegTech – The New Fintech Frontier. Retrieved from www.fintechmagazine.com