Newtek Bank High Yield Savings: A Comprehensive 2026 Guide to Maximizing Your Returns

In the evolving financial landscape of 2026, savers are increasingly looking beyond traditional “Big Four” banks to find vehicles that actually outpace inflation. Newtek Bank, a subsidiary of NewtekOne, Inc. (NASDAQ: NEWT), has emerged as a frontrunner in the high-yield savings space. While originally known for its robust business banking solutions, Newtek Bank’s Personal High Yield Savings account has become a cornerstone for individual savers seeking top-tier rates without the complexity of traditional brick-and-mortar institutions.

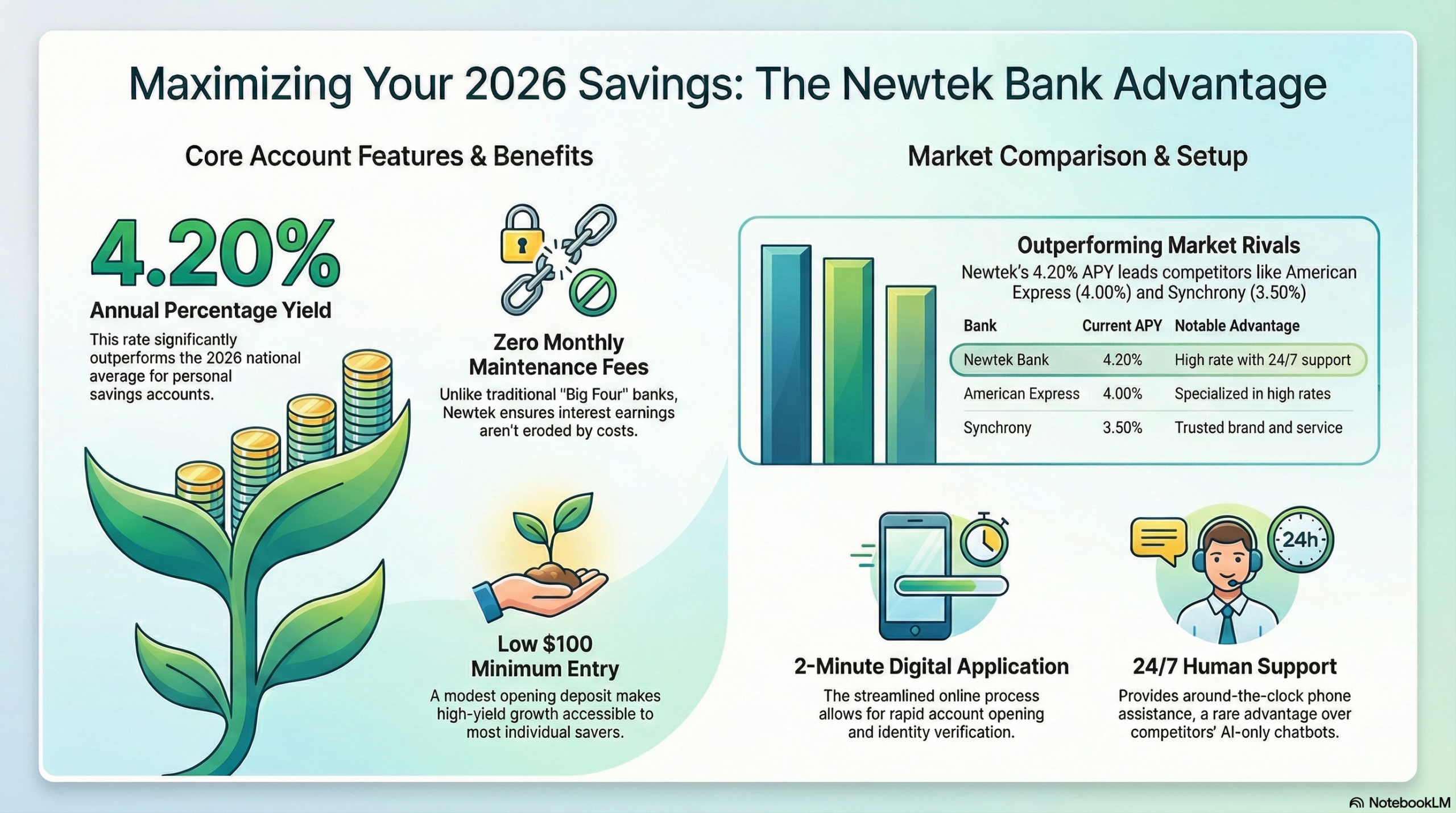

As of February 2026, Newtek Bank offers an Annual Percentage Yield (APY) that significantly outperforms the national average. This article provides an in-depth analysis of Newtek Bank’s savings products, comparing them with industry rivals and offering actionable strategies to optimize your financial planning in the current economic climate.

1. Understanding Newtek Bank High Yield Savings in 2026

Newtek Bank’s High Yield Savings account is designed for the modern, digital-first saver. It is an FDIC-insured account that prioritizes high interest and low overhead. In an era where the Federal Reserve’s maneuvers continue to influence market rates, Newtek has maintained a competitive edge by keeping its operating costs low and passing those savings to its customers.

Who is this account for?

- Emergency Fund Builders: Those looking for a safe, liquid place to store 3–6 months of living expenses.

- Goal-Oriented Savers: Individuals saving for a down payment, a wedding, or a major purchase within the next 1–3 years.

- Yield Seekers: Investors who want a low-risk component in their portfolio that still offers meaningful growth.

2. Current Interest Rates and Key Features

As of February 18, 2026, the primary features of the Newtek Bank Personal High Yield Savings account are as follows:

| Feature | Details |

|---|---|

| Annual Percentage Yield (APY) | 4.20% |

| Minimum Opening Deposit | $100 |

| Monthly Maintenance Fees | $0 |

| Minimum Balance to Earn APY | $0.01 |

| Withdrawal Limit | 6 per statement cycle |

| FDIC Insurance | Up to $250,000 (Member FDIC) |

Key Highlights:

- No Monthly Fees: Unlike many traditional banks, Newtek does not charge a monthly service fee, ensuring your interest earnings aren’t eroded by “maintenance” costs.

- Rapid Account Opening: The digital application process is streamlined, often allowing new customers to open an account in under two minutes.

- 24/7 Support: Newtek provides around-the-clock phone support, a rarity among digital-only high-yield offerings.

3. 2026 Competitor Comparison

To understand Newtek’s value proposition, it is essential to compare it with other leading high-yield savings accounts available in the U.S. market as of early 2026.

| Bank | Current APY | Min. Opening Deposit | Monthly Fees | Notable Pros |

|---|---|---|---|---|

| Newtek Bank | 4.20% | $100 | $0 | High rate, 24/7 support |

| SoFi | 3.30% | $0 | $0 | Great all-in-one app, checking combo |

| Synchrony Bank | 3.50% | $0 | $0 | Consistent rates, easy UI |

| American Express | 4.00% | $0 | $0 | Trusted brand, great service |

| Vio Bank | 4.03% | $100 | $0 | Specialized in high rates |

Insight: While some niche banks like Varo may offer up to 5.00% APY, those rates often come with strict requirements (e.g., direct deposit minimums or spending limits). Newtek Bank remains a top choice for those who want a high rate without “jumping through hoops.”

4. Strategies to Maximize Your Savings in 2026

Earning a high APY is only the first step. To truly optimize your returns in 2026, consider these advanced saving strategies:

The Compound Interest Advantage

Interest in a Newtek account is typically compounded daily and credited monthly. To maximize this, automate your savings. Setting up a recurring transfer on payday ensures that your principal grows consistently, allowing the “snowball effect” of compound interest to work more effectively.

The “Laddering” Strategy

While the High Yield Savings account offers liquidity, Newtek also offers competitive Certificates of Deposit (CDs). In 2026, many experts recommend a “CD Ladder.”

1. Keep your emergency fund in the High Yield Savings account for immediate access.

2. Split excess cash into multiple CDs with different maturity dates (e.g., 6 months, 12 months, and 24 months).

3. As each CD matures, you can either spend the cash or reinvest it at the current market rate, providing a balance of liquidity and higher locked-in yields.

5. Pros and Cons of Newtek Bank

Every financial product has trade-offs. Here is a balanced evaluation of Newtek Bank based on 2026 market conditions.

Pros

- Exceptional Yield: Consistently ranks in the top tier of national savings rates.

- Low Barriers to Entry: A modest $100 opening deposit makes it accessible to most savers.

- Security: Full FDIC protection provides peace of mind.

- Customer Service: Access to 24/7 human support is a significant advantage over AI-only chatbots used by some competitors.

Cons

- Limited Personal Products: Newtek does not currently offer a personal checking account, meaning you’ll need to link an external bank for daily spending.

- Mobile App Focus: While the app is functional, some advanced features like mobile check deposit have historically been prioritized for business users.

- No Physical Branches: As a digital-first bank, it is not suitable for those who prefer in-person banking.

6. How to Open an Account: A Step-by-Step Guide

Opening a Newtek Bank High Yield Savings account in 2026 is a straightforward digital process.

Eligibility Requirements:

- Must be a U.S. citizen or permanent resident.

- Must be at least 18 years old.

- Must have a valid Social Security Number (SSN).

Documentation Needed:

- Government-issued ID: Driver’s license, state ID, or passport.

- Personal Information: Address, date of birth, and contact details.

- External Bank Info: Routing and account numbers for your initial $100 deposit.

The Process:

- Visit the Website: Navigate to Newtek Bank’s Personal Savings page.

- Click “Open Account”: Fill out the secure online application (estimated time: 2–5 minutes).

- Verification: Newtek will perform a standard identity verification (usually a “soft pull” on your credit, which doesn’t affect your score).

- Fund Your Account: Link your external bank and transfer at least $100.

- Access: Once approved (usually within 24–48 hours), you can set up your online banking credentials.

7. Expert Commentary and Customer Sentiment

Financial experts in 2026 continue to praise Newtek for its transparency. NerdWallet and Bankrate consistently rate Newtek highly for its “no-nonsense” approach to savings—avoiding the hidden fees that plague larger institutions.

Customer Experience:

Reviews on platforms like Trustpilot highlight the simplicity of the interface. One verified user noted, “I was tired of my big bank paying 0.01%. Switching to Newtek took five minutes, and I’m now earning hundreds more in interest every year without changing my habits.”

8. Financial Planning and Tax Considerations

Emergency Funds

In 2026, with shifting labor markets, experts recommend maintaining 6 months of expenses in a liquid high-yield account. Newtek’s 4.20% APY ensures that your “safety net” is growing, not shrinking in real value.

Tax Implications

Remember that interest earned in a high-yield savings account is considered taxable income. Newtek will provide a Form 1099-INT at the end of the year if you earn more than $10 in interest. Factor this into your tax planning to avoid surprises in April.

9. Final Verdict: Is Newtek Bank Right for You?

Newtek Bank High Yield Savings is an elite choice for U.S. savers in 2026. It combines a top-of-market interest rate with the security of FDIC insurance and the convenience of 24/7 support. While the lack of a personal checking account may be a minor inconvenience for some, the sheer earning potential makes it a powerful tool in any financial arsenal.